Cryptocurrency Regulation US

In 2008, Satoshi Nakamoto created the innovative Bitcoin, explaining in a whitepaper what a digital coin is and describing how to use the blockchain protocol.

By 2023, crypto and blockchain technology has evolved a lot, becoming nothing less than an industry borrowing a lot from traditional finance, in particular banking, exchanges and hedge funds, traditional databases, the gaming industry, and more. Over the past 15 years, a new digital economy has emerged, and, of course, state regulators could not overlook this phenomenon.

What is cryptocurrency? How to tax crypto trading and crypto payments? What are the rights and obligations of crypto holders, traders, investors, and crypto firms like Binance or Uniswap?

Why regulate? In the traditional finance, people make agreements with public and private financial institutions. General rules are spelled out in the legislation of any country in the world. Cryptocurrency markets, improving exchange processes and ways of storing money using blockchain technology, in some way duplicate the traditional financial sector. However, those who use cryptocurrencies often find themselves unprotected in cases of theft and hacking, scammed by phishing exchanges and crypto tokens.

The states of the whole world, including African regions and closed countries like North Korea, are looking for their own ways to form a crypto framework. One of the leading countries in crypto adoption and regulation is the USA. Although, it is worth noting the complexity of the legislation governing the digital economy. But that's why it's more interesting for research! We offer a closer look at the crypto laws adopted in the States and the problems of control over crypto exchange by various agencies.

Crypto Regulators US

It is worth starting with the remark that cryptocurrency is an ambiguous concept. There are stablecoins, there is Bitcoin, there are altcoins, as well as tokens, fungible and non-fungible (NFTs). These are digital assets that often serve different purposes.

Another important caveat is that there is no such institution in any state of the world that would be responsible for everything related to money and the exchange of values. Financial systems and authorized institutions are divided into tax authorities, central banks, securities commissions, and others. Now that the turn has come to crypto regulation, various agencies are claiming their rights to control the area.

It is difficult to briefly answer the question posed in the title of this article. In the United States, cryptocurrencies are regulated by several agencies, and each defines digital finance in its own way, based on its goals and objectives. Talking about the key crypto regulators in the US, we will try to reveal the features of the definitions and problems of control.

Securities and Exchange Comission (SEC)

You have probably seen the news that the Securities and Exchange Comission has once again charged a crypto broker, a trading exchange, or even a celebrity. For example, we can recall the SEC case against star Kim Kardashian for touting on social media a crypto asset security offered and sold by EthereumMax without disclosing the payment she received for the promotion.

The purpose of the Securities and Exchange Commission is to maintain a transparent and fair securities market where investors are sufficiently protected when entering.

To assign an asset to the security category, back in 1946, the Commission introduced the Howey Test, named after the senator who initiated this classification.

So, an “investment contract”, accounted for by the SEC, can be considered to meet several criteria:

- An investment of money

- In a common enterprise

- With the expectation of profit

- To be derived from the efforts of others

Harry Gensler, head of the agency, has no doubt: “The law is clear. I believe based on the facts and circumstances most of these tokens are securities,” he said.

Here is how he explains his stance:

“If somebody is raising money selling a token and the buyer is anticipating profits based on the efforts of that group to sponsor the seller, that fits into something that's a security.”

However, there are a number of contradictions and inaccuracies in the SEC position. These problems are highlighted by researchers from Harvard Law School, pointing to the proliferation of definitions that confuse the subjects of legislation:

These factors range widely and include, for example, whether so-called “active participants,” which can include a “promoter, sponsor, or other third party,” from time to time have a role in developing, marketing, improving or operating the blockchain project; whether an active participant “owns or controls ownership of intellectual property rights of the network or digital asset, directly or indirectly;” and whether the cryptoasset “is transferable or traded on or through a secondary market or platform, or is expected to be in the future.”

Commodity Futures Trading Commission (CFTC)

The CFTC is an agency that regulates the derivatives markets, including futures contracts, options, and swaps, in the United States.

In 2015, the U.S. The Commodity Exchange Act stated: “The definition of a “commodity” is broad. Bitcoin and other virtual currencies are embraced in the definition and properly defined as commodities.” However, later on, the division of powers became more complicated, and the CFTC never got full control over the crypto industry.

Currently, the agency regulates derivatives such as futures, options and swaps.

Understanding how the Commission works in crypto regulation is easy using the example of Bitcoin. There is no dispute that Bitcoin is a commodity, not a security.

BTC is interchangeable. The price of each identical BTC depends on the supply and demand in the market, not on the creator or “centralized entity.”

SEC regulation is needed in cases where an organization or person is issuing a digital asset to obtain benefits.

In August 2022, the Digital Commodities Consumer Protection Act of 2022 was initiated by Ms. Stabenow and Sen. John Boozman. The bill implies acceptance of the authority of the CFTC regarding the regulation of digital assets that act as commodities, such as BTC and ETH. That's what Sen. John Boozman thinks about this:

“The bill is a good-faith effort to establish a constructive regulatory framework that provides the CFTC with the resources and the authority necessary to protect consumers and retail investors while promoting industry innovation in digital commodity spot or cash markets.”

Federal Trade Commission (FTC)

The mission of The Federal Trade Commission (FTC) is to enforce antitrust laws in the United States, preventing and eliminating anticompetitive business practices, including coercive monopolies. The FTC also seeks to protect consumers from predatory or misleading business practices, as they say.

In December 2022, The US Federal Trade Commission announced that it was investigating several crypto firms whose names it has not yet named. The investigation concerns allegations of misleading advertising activities.

“We are investigating several firms for possible misconduct concerning digital assets,” FTC spokeswoman Juliana Gruenwald Henderson said in a statement to Bloomberg News. She declined to offer further details on the confidential probes.

Internal Revenue Service (IRS)

The primary purpose of The Internal Revenue Service (IRS) is to collect individual income taxes and employment taxes.

The IRS 2022 Tax Guidelines made several adjustments regarding crypto definitions. So, the agency proposed to change the term “virtual currency” to “digital asset”, including NFTs in the category of digital assets. Also, in this document, a yes or no question to Form 1040, used by taxpayers to file federal income tax, has been finalized.

At the moment, this is the foundational law for the deployment of tax regulation of crypto by the IRS.

Let’s find out in which cases crypto is tax-free. According to the IRS, you don't owe taxes, if

- just buying and owning crypto;

- donating crypto to a charitable organization;

- get crypto as a gift;

- transfer crypto as a gift;

- you staked ETH and now hold ETH2.

The cases where the IRS requires payment of taxes for crypto-related transactions include those transactions where you receive crypto income. So, let's say you bought ETH for $860 and sold it for $3000, you'd report $2140 in gains. Now, NFT taxes work the same way.

When you sell crypto for cash, buy goods and services with crypto (or get crypto payments for this), or swap crypto for another, the taxable event is happening.

Other taxable situations include getting crypto as a salary and crypto income from staking and mining. You can read more about crypto tax payment events here.

Financial Crimes Enforcement Network (FinCEN)

FinCEN regulates all crypto assets for purposes of AML and combat the financial terrorism. In 2013, FinCEN was the first initiator of crypto guidance. This short document was designed to fit virtual currencies into the Bank Secrecy Act (BSA).

FinCEN identified several categories of virtual currency actors — administrators and exchangers — and classified them as money service businesses (MSBs). These categories are considered in more detail in the Bank Secrecy Act (BSA).

Later, in 2019, FinCEN issued CVC guidance, consolidating all FinCEN regulatory frameworks.

As stated in the document, the guidance “is intended to help financial institutions comply with their existing obligations under the BSA.”

As stated in the FinCEN order, Bitzlato, through Peer-to-Peer (P2P) services, facilitated and supported Russian darknet markets such as Hydra, officially closed in 2022, BlackSprut, OMG!OMG! and Mega. All these darknet markets are, of course, under sanctions in the US.

Earlier, in October 2022, FinCEN, in collaboration with the Treasury’s Office of Foreign Assets Control (OFAC), announced settlements for over $24 million and $29 million with Bittrex exchange.

According to FinCEN Acting Director Himamauli Das, “Bittrex's failures created exposure to high-risk counterparties including sanctioned jurisdictions, darknet markets, and ransomware attackers.”

Crypto Law

As we said, US crypto frameworks are an area that is constantly being updated and ambivalent. The Executive Order (EO) of the Biden Administration is now called the first crypto framework, which outlines the main provisions and points of support for the adoption of full-fledged laws based on already developed proposals.

On March 9, 2022, the “first-ever comprehensive framework for the responsible development of digital assets” was adopted. The document that President Biden signed is called the issued Executive Order on Ensuring Responsible Development of Digital Assets (EO).

This White House executive order on crypto focus on six priorities: financial stability, illicit activities, consumer protection, U.S. competitiveness, financial inclusion, and responsible innovation.

EO, a long-awaited directive, also does not bypass the issue of crypto's environmental impact. As the head of the country points out, industry should take responsibility for the negative climate impacts.

Biden also called for “urgency” on research of a CBDC, an official digital currency like the fiat dollar. Now, there is practically no country that has started using CBDC. However, as in the US, the potential issuance of the digital equivalent of national currencies is being explored all over the world.

The official comment states: “The United States has an interest in ensuring that digital asset technologies and the digital payments ecosystem are developed, designed, and implemented in a responsible manner that includes privacy and security in their architecture.”

However, some other acts and bills cannot be ignored. We will tell you about the most recent and relevant approaches to crypto regulation:

Toomey Stablecoin Bill 2022

Continuing the question of stablecoins. At the end of 2022 Sen. Pat Toomey (R-PA) introduced an updated version of the Stablecoin Transparency of Reserves and Uniform Safe Transactions (TRUST) Act, which allows more companies to issue stablecoins.

Toomey is known as a long-time crypto advocate with a liberal attitude towards digital finance. That is why a stablecoin bill allows several types of entities, including depository institutions, state-based money-transmitting businesses, and national trust banks, to act as stablecoin issuers. Issuers, of course, will be required to back their stablecoins with “high-quality liquid assets” and have a 100%+ reserve.

Sen. Toomey hopes that “this framework lays the groundwork for my colleagues to pass legislation next year safeguarding customer funds without inhibiting innovation.”

According to the senator's proposal, stablecoin regulation will be given over to the Office of the Comptroller of the Currency (OCC). The OCC regulates traditional banks and savings institutions, Toomey considers it necessary to create a new federal license for “payment stablecoin issuers” to control stablecoins.

The Virtual Currency Tax Fairness Act of 2022

Are there taxes on crypto transactions in the US? In what cases and what laws govern taxation in the field of crypto?

The bipartisan team of Senators Patrick Toomey and Kyrsten Sinema in July 2022 presented an updated The Virtual Currency Tax Fairness Act. Currently, all crypto purchases are taxed, and the capital gains tax ranges from 0%–20%.

The bill proposed by the senators would place a tax exemption limit on purchases at $50. The Virtual Currency Tax Fairness Act of 2020 established the upper limit of the tax exclusion at $200.

Changes to the current Internal Revenue Code proposed by Toomey and Sinema target small personal transactions that use virtual currencies for goods and services. Such an update is said to promote the rapid adoption of crypto in everyday practice. The legislative innovation also applies to trades where the user makes less than $50.

The Anti-Money Laundering Act of 2022

Against the backdrop of speculation in the crypto industry revealed in 2022, state regulators have adopted the already existing The Anti-Money Laundering and financing terrorism legislation and updated it. Many considered the proposed innovations to be an adequate measure, and some were outraged by the attack on the personal freedom and privacy of users by cryptocurrency.

The Digital Asset Anti-Money Laundering Act will oblige to implement know-your-customer (KYC) rules to crypto-financial institutions that are used to store and transfer digital assets like wallet providers and miners, validators, or other nodes.

If legislation is passed, control will also affect non-custodial wallets, as it will allow the Financial Crimes Enforcement Network (FinCEN) to implement a rule requiring institutions to report certain transactions.

So, this law, one might say, opposes anonymity and personal control over one's funds. Intervention in public-private key cryptography has already taken place and was canceled due to a violation of the first amendment of the US Constitution, which affirms freedom of speech. Yes, the code has been interpreted as a language, a speech that, like ordinary speech in English, is protected by the main law of the United States.

Likely, financial institutions and crypto infrastructure will not remain confidential, regardless of the evidence of criminality related to transactions.

As claimed by one of the authors of the bill, Elizabeth Warren (D-Mass), the bill targets to halt crypto assets potentially associated with financial terrorism and money laundering by oligarchs, drug lords, and human traffickers.

Bank Security Act (BSA)

The Bank Secrecy Act is closely related to anti-money laundering and financial terrorism controls. BSA obliges all financial institutions to enact KYC policy and monitor transactions. Now, crypto exchanges fall under BSA jurisdiction and must register with FinCEN.

Back in 2013, FinCEN issued a guide on how the BSA determines the status of an individual or company related to cryptocurrencies. The Act establishes several financial institutions that are required to collect and retain information about their customers.

Trading platforms and payment systems recognized as money transmitters offering to buy and sell convertible virtual currency must comply with the Bank Secrecy Act.

Cryptocurrency creators, individuals, and businesses that use cryptocurrencies for their own purposes are not subject to the Act. Miners are also not covered by the BSA.

The published FinCEN text defines three categories: Administrators, Exchangers and Users. Only Administrators and Exchangers are recognized as Money transmitters.

Administrators are “pengaged as a business in issuing (putting into circulation) a virtual currency, and who has the authority to redeem (to withdraw from circulation) such virtual currency.”

An exchanger is recognized as “a person engaged as a business in the exchange of virtual currency for real currency, funds, or other virtual currency.”

Is Crypto Federally Regulated?

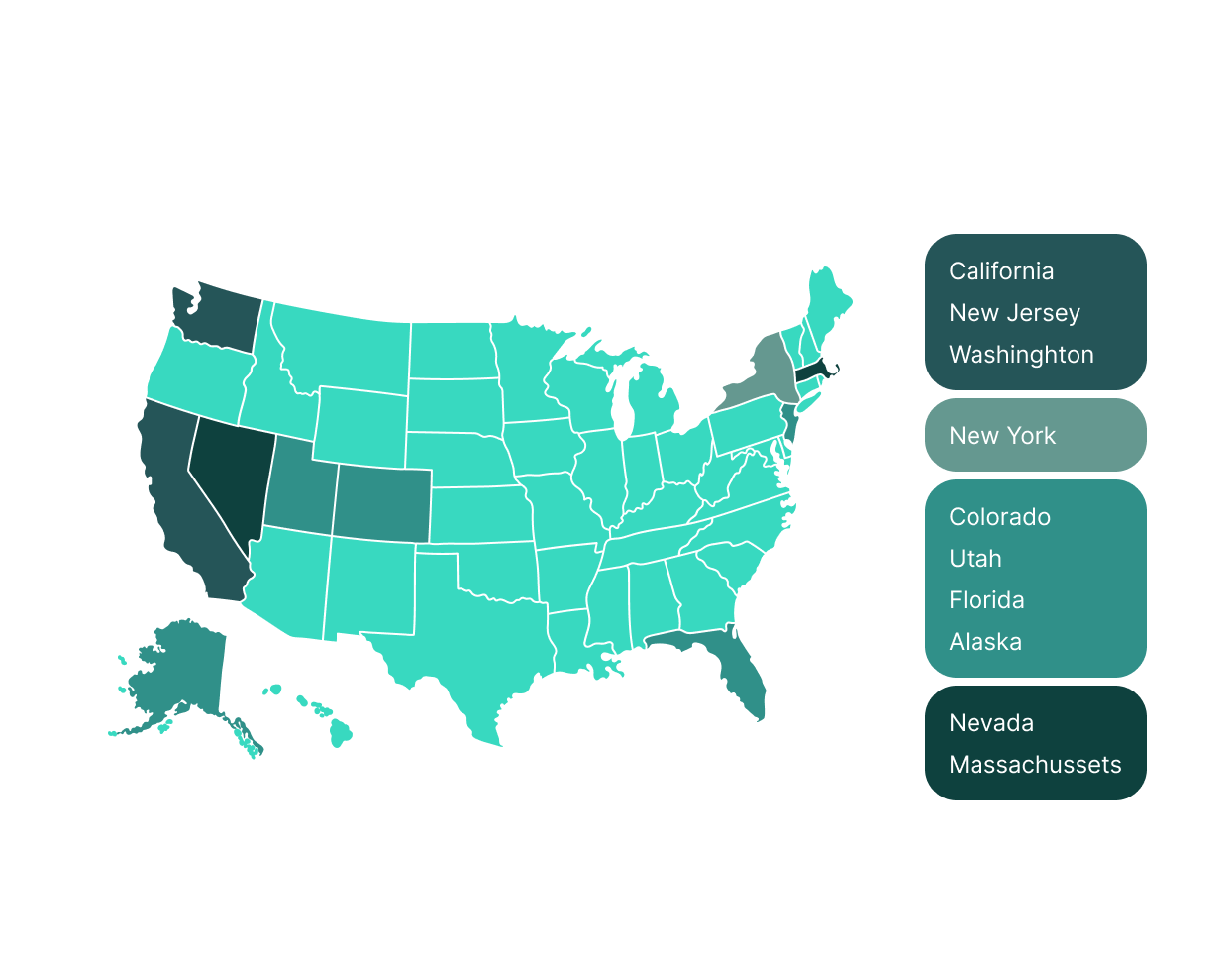

One of the most relevant studies on the attitude towards crypto by US citizens and regulators and regulation in different US states was published on January 30, 2023.

The 50-page study provides a brief overview of the features of the recognition of crypto as a legal tender in each of the states of North America.

But it's important to note that the U.S. The Constitution doesn't allow individual states to create their own legal tender, however. All initiatives of regional authorities are always based on federal legislation.

According to a static report prepared by major centralized crypto exchange Coinbase, California, New Jersey and Washington top the rankings of states with the highest percentage of population that owns crypto. The TOP10 is shown in the image below.

It is difficult to explain briefly how crypto regulation differs in the US states. It's worth saying that the differences are not huge. Therefore, we will tell you some general facts about crypto adoption in some states of the country:

Wyoming has gained a reputation as a forward- thinking regulatory haven for blockchain companies. It is the home of the crypto exchange Kraken’s bank and has recognized decentralized autonomous authorities (DAOs) as legal entities.

New York state is one of the biggest sites for crypto mining in the United States, contributing 19.9% of the country’s total Bitcoin hash rate.

Texas is also a major hub for crypto mining with over 14% of the country’s hash rate due to its cheap electricity and abundance of land.

San Francisco and Los Angeles both had some of the biggest shares of total crypto hires this year. Popular cryptocurrency exchanges like Kraken and Coinbase are headquartered in San Francisco.

Louisiana’s authorities announced the initiative that would allow the creation of 640-acre deregulated energy zones by the native government. These zones would make it simpler for power producers and Bitcoin miners to associate with each other effectively.

Conclusion

Some barriers still stand in the way of full and unambiguous regulation of crypto in the US. Frameworks created by various agencies are constantly being updated to meet the needs of the times. The first guides on crypto legislation, for example, did not include collectibles, NFTs.

Now, the government agencies are faced with the task of bringing all this into order and consistency between different jurisdictions. Unfortunately, now, the balance between the competencies of separate regulators, such as SEC and SFTC, is not completely clear.

It is incorrect to call the US the most advanced country in terms of approach to crypto regulation. The United States is a difficult case, at least due to the federal structure of a huge state. The US, along with the European Union, African and Asian countries, is looking for its own ways to understand how to integrate digital finance into the everyday real world.

We look forward to 2023 bringing us more elaborate and complete initiatives.

Right now, bitoftrade has released new products that developers and businesses can take advantage of! Find out more about

Cross-Chain Messaging Protocol

Follow our social media to stay up to date with the latest all-in-one bitoftrade platform news: