Intro

According to a recent study by CoinGecko, people all over the world try to figure out what NFT is by typing a question in Google search 948,000 times each month. NFTs have been a major topic throughout 2021, but to this day, there is widespread misunderstanding of what this digital phenomenon is all about.

Another statistic for NFT's popularity is Google Trends data showing that the word is even more popular than “crypto” this year.

In this article, we will help you deal with the basic questions about what non-fungible tokens are, why they are so valuable and what prospects await this sector.

NFT Explained

The creator can mint many copies of NFT in the form of MP3, JPEG, but each one will be a unique product. The difference between NFT and any other token is that NFT has no exact market value. For example, it is impossible to objectively assess the value of the painting. You can exchange 10 MATIC for ETH, and you will end up with the same amount only in a different cryptocurrency. NFTs can't be exchanged like that.

It's easier to understand the meaning by looking at the examples. We want to tell you in which areas NFT is becoming in demand, and we will start by considering NFT as a newfangled component of digital art.

NFT Art

The NFT enthusiasts recalls that there is almost no copyright in the Internet space, which protects the creators of cultural values, and also complains about the modest opportunities for creators to earn money from their work. NFT solves this problem.

Previously, the artist distributed his work on the network without the ability to track who uses it (anyone can save the picture and pass it off as their own, the same with music), but with the introduction of smart contracts in the field of art, it became possible to track the creator and owner of the art items.

The metadata of each NFT, recorded on the blockchain, contains details of the current owner, token's meaning, and transactional history. At the moment, about 80% of the NFT volume is on the Ethereum network, in such cases you can use the Etherscan tool to track non-fungible tokens. Platforms like DappRadar have been developed to track NFTs on all possible networks, such as Solana, BNB Chain, Polygon, Cardano, and so on.

Now, digital content can be sold on huge global sites such as OpenSea, Rarible, SuperRare, etc.

Blockchain and NFT make it possible not only to fully own the rights to digital artworks and receive monetary benefits but also to freely enter the NFT art market. To upload their work to an open marketplace, authors only need to make a few clicks, mint (the process of creating currency and NFTs on a blockchain) NFT and connect their crypto wallet, which will receive payment for the purchase of the item.

The advantage of NFT marketplaces is that they do not involve third parties to make sales. In short, artists are autonomous, they don't need agents who charge a fraction of the price of the artwork for their intermediary work.

We have talked a lot about the advantages of decentralized finance and services in our articles:

CeFi vs DeFi, or Why We Should not Trust Centralized Trading Platforms

The Era of Anonymous Cryptocurrency: What Traders Should Know

Decentralized (DEX) vs. Centralized Exchanges (CEX)

DEX vs CEX: Know Where to Trade

It is worth noting that the NFT is open to both novice artists and venerable authors. On marketplaces, transactions are made for both $5 and $5,000. According to Finder's research, the average cost of NFTs is no more than $200. To outline the scope of this area, we will show you the most expensive sales of NFT artworks.

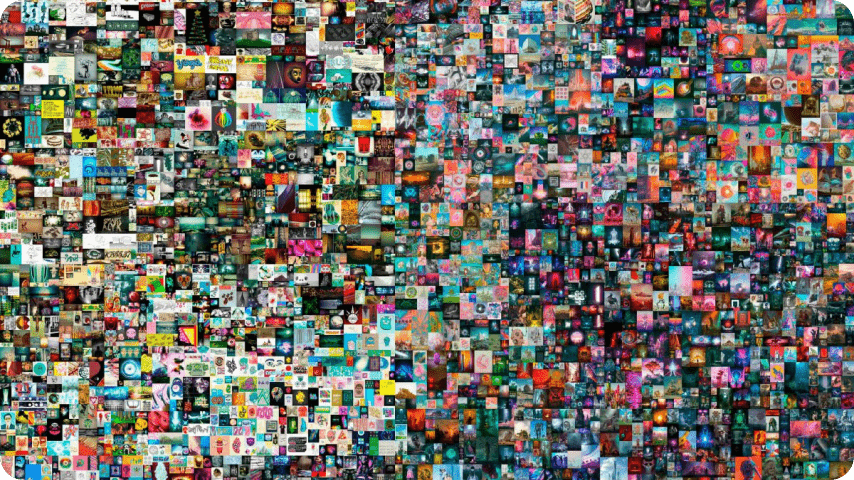

In 2021, Mike Winkelmann, the artist known as Beeple, was named among the “top three most valuable living artists” after selling his painting to the NFT for $69 million at the auction house Christie’s. The title of the piece is “Everydays: The First 5000 Days.”

Another big NFT trade was the “Сlock” painting. In early 2022, it was the second-largest single NFT sale after Beeple's artwork, selling for nearly $53 million. “Сlock” features a timer showing how many days WikiLeaks creator Julian Assange has to wait before being extradited to the United States.

It would be unfair to understand NFTs in the realm of art as purely pictures. NFT is also audio recordings. In our Web3 article, we talked in detail about the streaming music platform Audius, where users can post their music and receive donations for listening directly from listeners without intermediaries. We recommend this text for your consideration.

However, Audius is a slightly different music distribution approach. On the blockchain-based decentralized platform, there is no option to buy NFTs in MP3 format, Audius works as an aggregator that connects the musician and the listener. The purchase of non-fungible MP3 records is possible on the above-mentioned marketplaces — OpenSea, Rariable, as well as specialized sites Catalog, AsyncMusic, Sound.xyz, and more.

Maybe you want to ask yourself: why buy an MP3 NFT when you can buy a track on iTunes or donate to a Bandcamp musician? The difference is that by purchasing music from iTunes, the user only gets the right to listen to the licensed version of the song. By buying the same NFT record, the user begins to dispose of it as the owner.

There are also several platforms (hopefully, this trend will find its way) like Opulous or Royal aiming not only to provide on-chain ownership but royalties, a share for token holders through an agreement established with the artist.

NFT Gaming

Another sector in which NFTs have played an innovative role is the gaming industry. Web2 and the games created for the last twenty years have been developing on the principle of pay and play. Buy clothes for the character, buy more advanced tanks, and more.

When NFT exploded in popularity, Play-to-Earn games began to take over the world. An example of this is one of the token base games Axie Infinity, where players create cute fierce creatures.

The Fully Diluted Market Cap of this gaming universe is $2,052,000,829 as of today. In 2021, Axie generated over $1.3B in revenue and attracted over 2 million daily players.

According to data by exchange ByBit, at least 9% of the United States population have played a Play-to-Earn NFT game. A popular thing!

The difference between P2E games and the games we are used to is that in-game objects written on smart contracts give freedom to cash out and extract value from the game. Thus, the NFT provides ownership over in-game assets and allows not only game product developers to earn money but also users.

Again, it's about the right to own. In-game NFTs belong to the users, not the game developers, and even if the game is closed, the assets, which can be in the form of characters, items, skins, virtual land, and so on, will remain in the user's wallet. These accumulated assets can be traded by the user for cryptocurrencies or fiat money.

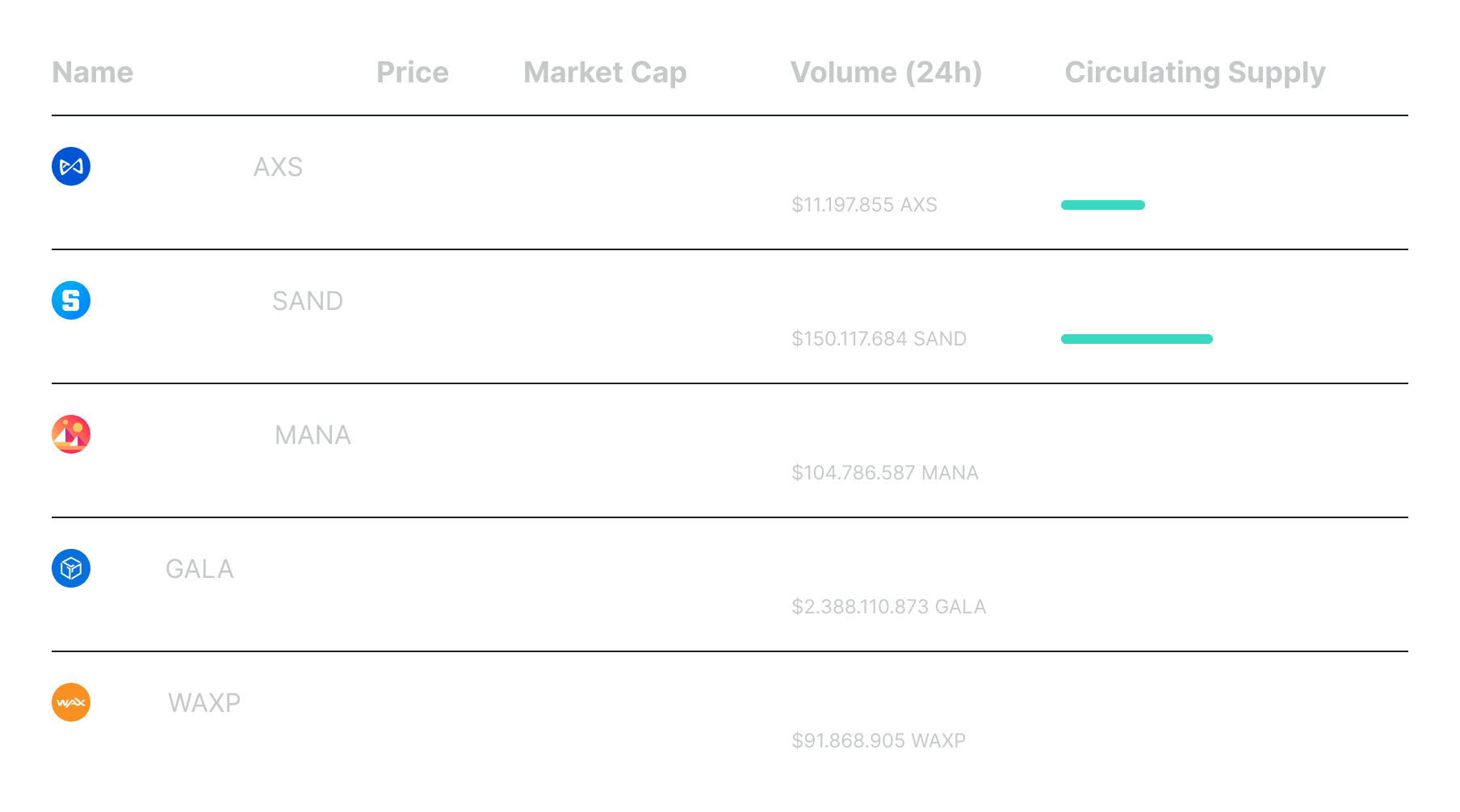

Let's take a look at the TOP-5 Play-to-Earn games by market capitalization:

Sports NFTs

Non-fungible tokens are also widely traded in sports. Sports NFT market is expected to reach US$41.6 billion by 2032, according to the latest Market Decipher data.

Maybe, as a child, you collected cards with your favorite football and basketball player? Now, these are available in digital form, and sometimes these pictures move like GIF images. One of the NFT video clips of the legendary NBA game highlight sold in April 2021 for almost $400,000. In general, the collection of NBA Top Shot is one of the most popular among fans.

Sports NFTs come in the form of trading cards, sportsmen's wearables, and accessories like shoes, T-shirts, and so on. Sports fans also get collectibles autographs, awards, and trophies. As already mentioned, the hottest moments from the matches can be NFT video clips.

NFT Fashion

The NFT has found distribution in a wide variety of areas - the music industry, fine arts, gaming, sports, and so on. We are seeing how NFT is becoming one of the trending features that should be present in the range of any brand.

For example, sportswear giant Adidas has launched its own NFT collection, which gives an access pass to exclusive physical and digital Adidas drops. This brought the company $23 million.

Adidas competitor, Nike, created the .Swoosh Web3 platform. NFT t-shirts and sneakers hosted on the platform, users will be able to use in Web3 games, as well as get access to exclusive physical apparel. This NFT project will be minted on Polygon.

Nike and Adidas, however, did not pioneer the NFT. The first fashion NFT deal happened back in 2019 when a Fabricant-designed ‘Iridescence’ dress was sold on the blockchain for $9500.

Luxury goods companies have quickly taken the NFT trend on the back. According to the Vogue Business Index, by the end of 2021, 17% of the brands analyzed, including luxury brands Gucci, Dolce & Gabbana, Balmain, Jimmy Choo, Givenchy, and others, were creating their NFT products.

NFT Adoption

Let's talk big numbers. Currently, the total market cap of the NFT sector is over $11.3 billion. According to Nansen, in September 2022, OpenSea has seen 1.85 million transactions, 300,000 unique wallet addresses interacting with smart contracts, and 350,000 ETH trading volume.

According to the Verified Market Research (VMR) report, the NFT market cap of the industry could reach $231 billion by 2030.

How is the real world reacting to this?

Practical NFT Use Cases

Some regulators and researchers are looking at the NFT phenomenon with apprehension, suspecting a bubble in the new trend, explaining their fears by the fact that NFT projects lack any utility.

However, over time, it becomes clear that NFTs can be more than an executed smart contract that contains a link to the digital artwork.

The NFT can function as a document of confirmation. We mentioned NFT MP3 and NFT Sports Cards, but in the field of music and sports, NFTs also have the opportunity to become pass tickets — to a concert, to a match, and so on. Non-fungible tokens occupy the ticketing market space. It has been estimated that the NFT ticketing market is expected to be worth $68 billion by 2025 and presents a practical use case for NFT technology.

In general, the NFT date can be used as a confirmation of any fact. And in this regard, real implementation steps are being taken.

So, in 2018, The Massachusetts Institute of Technology (MIT) created the Digital Diploma Consortium, a network of universities where information about verified students’ credentials available for review is posted.

The purchase of a digital and real estate in the NFT format has also been taking place for several years. The easiest way to see this is on the example of metaverses of games like Decentraland or Sandbox. Users of the metaverses buy parcels and virtual lands. You can learn more about metaverses and NFT in our article:

How To Enter The Metaverse: Everything You Need To Know To Dive Into The New Digital Reality

Non-fungible assets enter the real world. Moreover, NFT mortgages are becoming popular. For the first time, this niche was occupied by the LoanSnap platform, providing refinance and mortgage options. In such transactions, loans are issued the same way as regular mortgages, only with the use of the NFT.

NFT-based mortgages are available on sites like Brightvine, Figure Technologies, Liquid Mortgage. These companies provide the ability to track and share mortgage data, as well as close agreements, more quickly than is the case in traditional paper-bureaucratic conditions.

NFTs are also used as evidence of the authenticity of a particular product. For example, a luxury watchmaker Breitling provides “digital passport” for authenticating its timepieces.

How Celebrities Impact on NFTs Market

It turns out that NFTs can do more than just benefit large corporations and independent digital artists. NFTs have become the driver of social charity projects. For example, TV presenter Ellen Degeneres sold an NFT drawing of her cat in 2021 and donated over $33,000 to a food-relief organization.

In the NFT sector, acute social problems are also being addressed right now. So, a largely male-dominated space was diluted with the creation of the NTF World of Women collection, actively supported by actress Reese Witherspoon. This NFT campaign is aimed at making female traders visible in the crypto space.

In 2021 singer Shawn Mendes in partnership with avatar company Genies launched a collection of concert-style collectibles at OpenSea. The money earned from the sale of digital wearables went to the musician's charitable foundation. According to the information on the official website, the fund is intended to help young activists with big ideas across a range of fields including music, film, human rights, education, science, environment and technology.

However, such a wide distribution of NFT among celebrities has a downside. Recently, a class action lawsuit was filed against several stars in California, including Justin Bieber, Madonna, Paris Hilton, and others, for allegedly misleadingly promoting and selling Yuga Financial Products.

This case speaks to the responsibility of media people to attract their fans to buy risky assets. At bitoftrade, we believe that each user should independently choose where to invest their own money without succumbing to aggressive hype from influential people.

Some Statistics

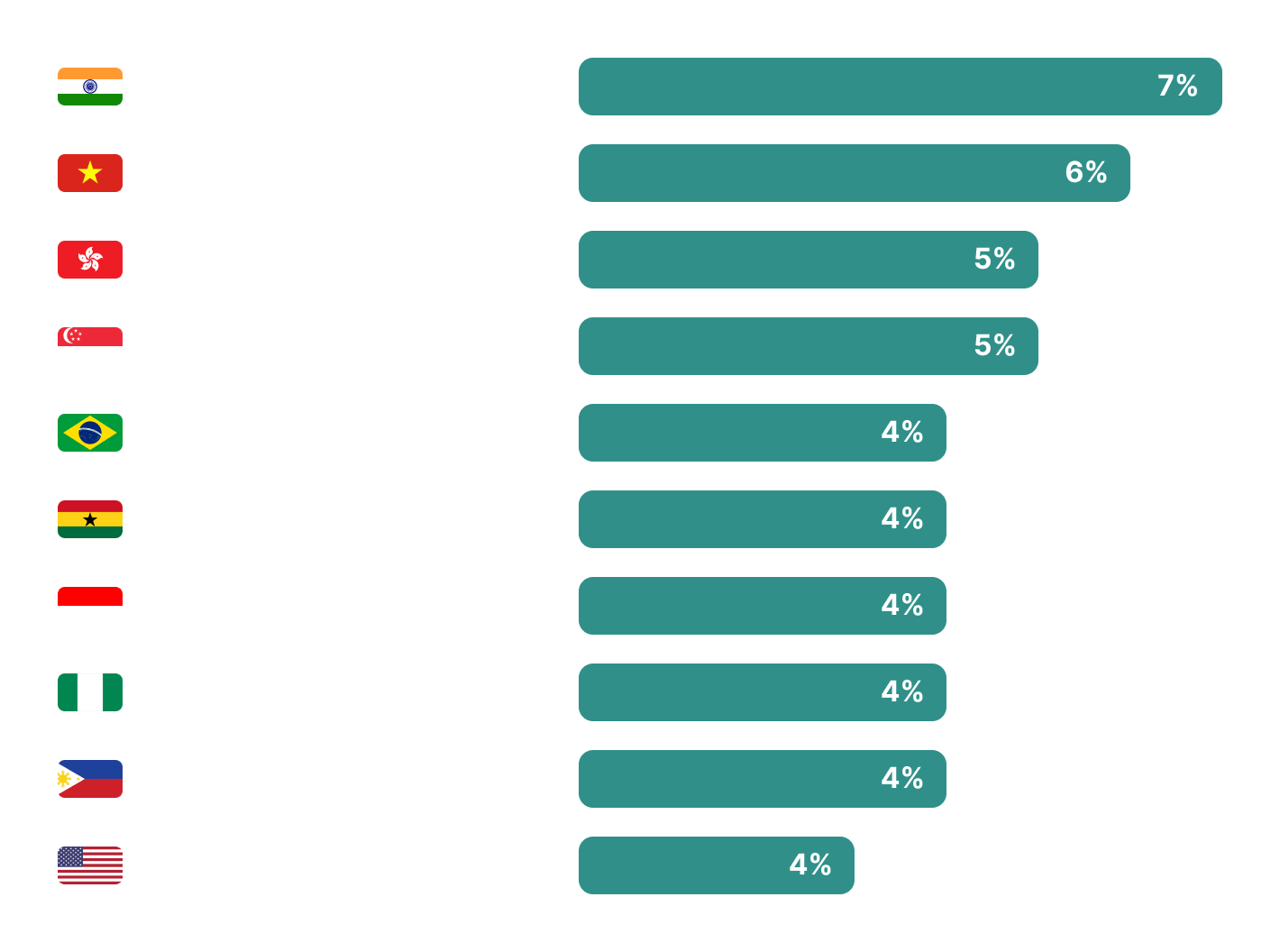

Let's take a closer look at Finder's statistics showing which countries are seeing the most interest in NFTs.

Amazingly, already now in Thailand and Malaysia, more than 20% of the population is aware of the NFT and owns non-fungible tokens. Filipinos lead among the studied countries, 32% of whose population owns NFT. By comparison: in the United States, 4% of the total population owns an NFT.

Here is the key stats on NFT adoption provided by the Finder:

However, it is worth noting that the majority of people in the world still have no idea what non-fungible tokens are. Thus, 80% of the population of the United Kingdom and 70% of Americans did not know about such a phenomenon when they were asked.

At the end of Q3 2021, the NFT trading volume increased by over 700% compared to the previous quarter. It was a real explosion. Weekly transactions, which were just 100 transactions recently, have started to cross 50,000.

As of September 2022, the largest NFT marketplace had almost two million transactions with 300,000 unique wallet addresses.

And although 2022 turned out to be a year of decline in volume trading after an explosive 2021, interest in the NFT remains stable among traders, artists, investors, and ordinary users.

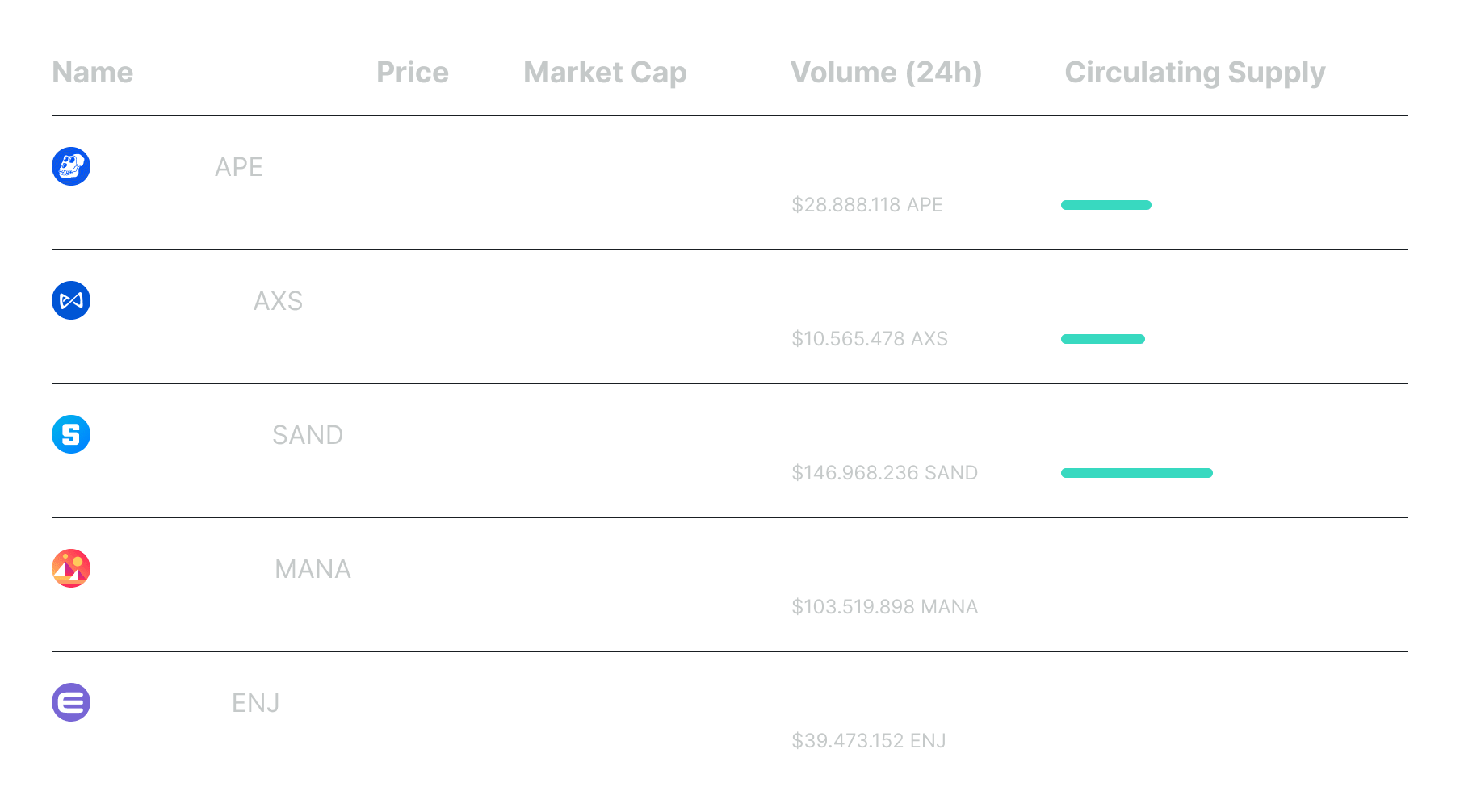

TOP-5 NFT Crypto Coins to Buy/Invest in

Before you start investing in NFTs, we warn you that cryptocurrencies are high-risk assets. The crypto market has been in the bear market for a long time.

You probably should not expect that investing in digital currencies will bring you significant income momentarily, however, of course, we do not discourage you from long-term investments.

The most popular NFT cryptocurrencies today are:

All of these crypto coins you can find on the bitoftrade trading widget.

Conclusion

NFTs emerged as a result of the development of the blockchain and crypto industries. In essence, non-fungible tokens are a natural component of Web 3 with its desire to digitalize all processes of real life, but on the condition that control remains with a specific user and not a third party.

The spread of non-fungible tokens in fashion, sports, games, art, and so on indicates the willingness of people to perceive not only physical objects but also intranet ones recorded on the blockchain. It turns out that something that cannot be touched also has its own value and represents a huge potential for trading and earning.

So far, we are only preparing to imagine the scope of the NFT sector in the future, but we already see its outlines. And we tell you about it.

If you found this article helpful, explore more our Blog posts :)

Subscribe to our social media to see more about decentralized crypto trading: