What is leverage trading? Leverage is a type of trade that can help greatly expand your profit potential! Find out how you can leverage your trades with bitoftrade.

In the current crypto climate, it’s now more important than ever to trade and expand your profit potential, while exercising caution as you go. Some traders are likely to avoid investing due to the current market state, the market cap fell to $922 billion in May, but you shouldn’t feel disheartened!

It can be difficult to decide which tokens to invest in, as recent events include the fall of LUNA’s Terra. However, don’t lose hope yet, there’s just as much chance for the market to rise as it is to fall! All you need to do is trade strategically — and you can do this by using leverage trading.

Fortunately, leverage is one of our advanced trading types that can help you build your portfolio. Learn all about it — how it works, its advantages, and how to use our leverage trading feature below!

How does crypto leverage trading work?

Perhaps you’ve stumbled on this article wondering: what does leverage mean in trading? Well, you’ve come to the right place. Cryptocurrency leverage trading helps you increase your buying capacity by paying less than the full price of your investment.

The amount you borrow is both relative to your initial investment and determined by your chosen leverage. For example, $100 with 10X leverage: $100 x 10 = $1,000. This means you can buy $1000 worth of tokens for $100. The higher the leverage, the more profit you can make. On the bitoftrade platform, you can have up to 20x leverage!

Using a simple formula can take you a long way when using leverage trading:

Profit or Loss = collateral x leverage x (% price movement) - fees

To learn more, read our article The Art of Leveraged Trading: A Professional Approach for more information on approaching leveraged trading.

Why leverage trading is profitable

Leverage trading is used by advanced traders who are looking to expand their profit margin. Why is leverage crypto trading so profitable? Well, leveraging crypto amplifies your profit potential and enables you to choose between 5 and 20 times the amount needed to open a position. You can make a profit by implementing long or short positions — you’ll read more about this later — but first, let’s look at risk reduction!

How you can reduce risks when trading with leverage

Leverage trading comes with risks. If your leverage is too high, it could lead to a potentially huge loss. However, there are ways you can protect yourself. To keep you protected, we’ve compiled a list of simple tricks and tips for trading on leverage with minimal risks:

Add stop loss to your leverage trade. You can reduce the amount you lose by applying a stop-loss order to your leveraged trades. A stop-loss order involves setting a maximum limit your investment can fall to before tapping out. Traders usually set it at between 5-10%.

Click here to learn everything you need to know to set up take profit/stop loss crypto limit orders!

Limit the amount you’re investing. To prevent huge losses, only leverage what you’re willing to lose. Don’t invest funds that you can’t afford to pay back!

Stick to a trading strategy. Trading with a plan will help you stay on track with profits and potential losses.

Check out our strategy article here for more tips on this!

Now that you know how to protect your portfolio, it’s time to learn all about leverage trading positions.

All about positions in leverage trading: long and short

Advanced traders use long and short positions for their leverage trades. If you haven’t come across them before, that’s okay, we’re about to tell you everything you need to know! Long and short positions refer to the two possible directions of a price required to make a profit from a leveraged trade.

Long position. A long position refers to the expected price of a token, rising from your specified position. You’ll likely hear people referring to this as “going long”. If you’ve noticed a pattern in a certain token, if it’s been rising at a certain time of day, for example, you’d be best advised to use a long position to help predict the next price.

Short position. As you may expect, a short position is the opposite of a long position. When using a short position, you’re expecting the price to fall from your specific position. People often refer to this as a “go short”. If you see that a token is falling in price (like LUNA), with a quick catch, you can likely predict the amount that it’ll fall to and, in turn, make a profit.

Don’t forget that you should support all your leveraged crypto trading by applying fundamental and technical analysis to each token you want to invest in.

You can learn all about fundamental and technical analysis and how they can help you predict market behavior in our latest articles here.

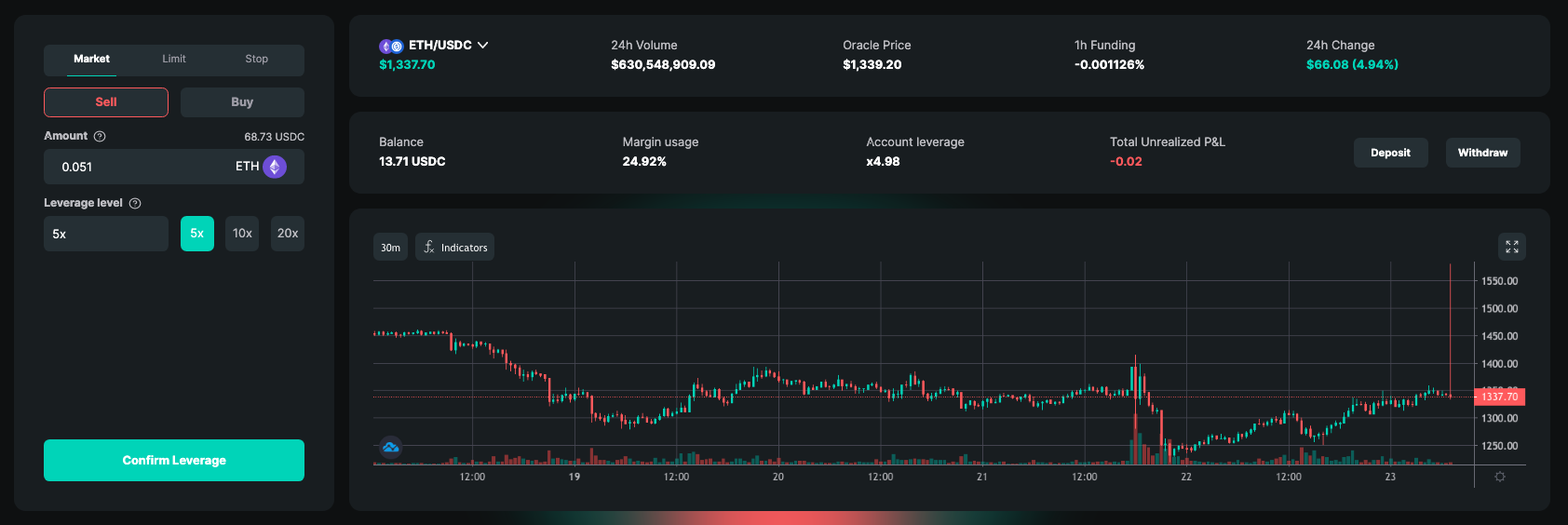

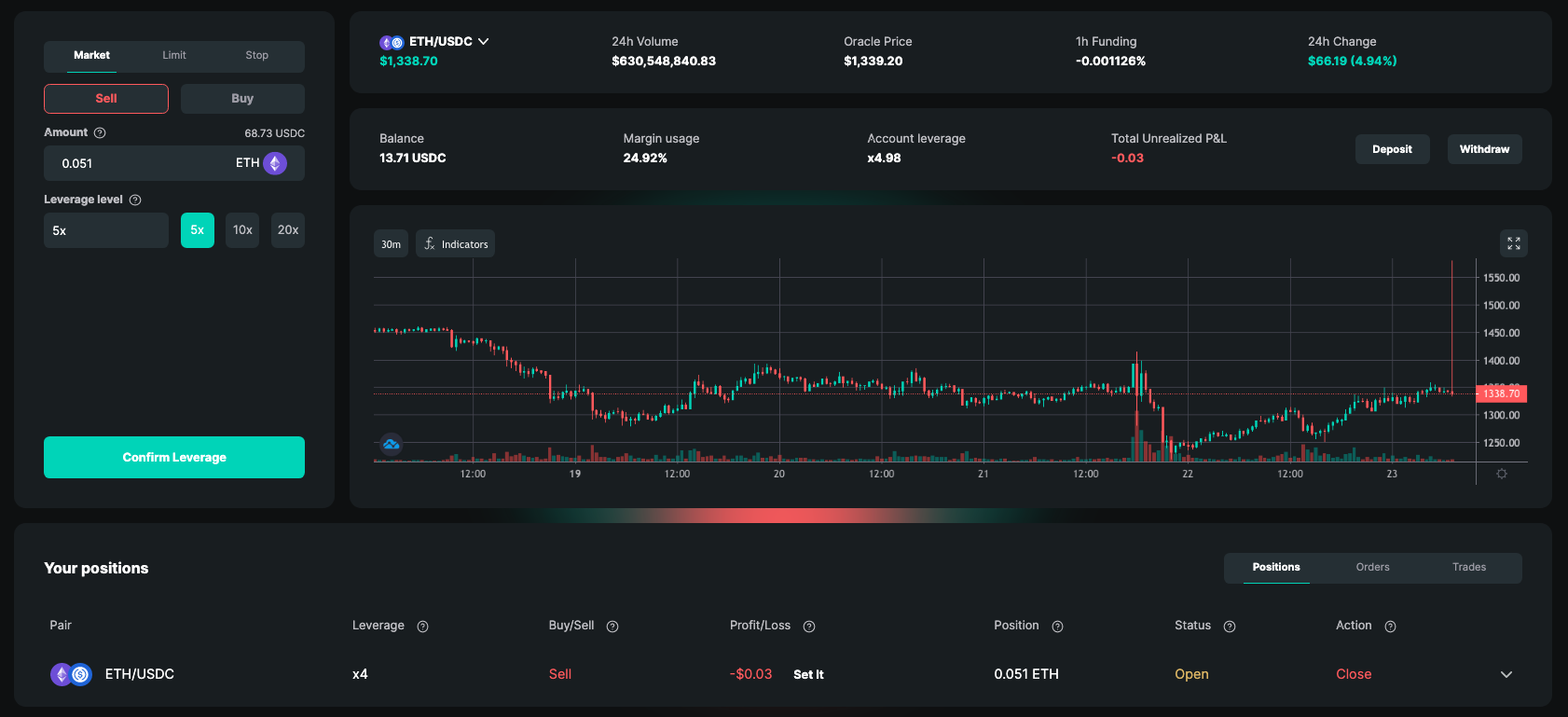

How you can leverage trade on bitoftrade

On our platform, we offer trading on leverage as one of our advanced trading tools. For this trading feature, we use dYdX. Make the most of leveraged trading on our platform by applying for market orders, limit trading, and stop-loss orders!

For more information on these trade types, visit our help center here.

Before you apply your newfound knowledge, now’s a good time to find out how you can leverage cryptocurrency with bitoftrade. Executing a leveraged trade on our platform has never been easier!

- Go to our trading dashboard and click “Start Trading”.

- Connect your wallet and select “Leverage” from the trading dashboard.

If it’s your first time using the leverage feature on bitoftrade, you’ll need to approve the procedure in five simple steps:

- Click “Link Wallet” and approve the two signing requests.

- Select “Create an Account”. This will create a leverage account linked to your wallet.

- Next, click “Approve USDC”. This is a one-time procedure (and includes gas fees) that enabled our smart contracts to interact with your USDC balance. This step may take several minutes.

- Deposit USDC to your leverage account. Leverage trading operates in USDC, so please make sure you have both USDC and ETH (to cover gas fees) in your wallet. This step may take several minutes.

- Now that you have a positive balance in your account you can start trading!

- Choose your leveraged token, the position, and the leverage level.

- Click “Confirm” to view your transaction summary and all estimated fees.

- You’re all set! You can view your open positions at all times and close them if needed.

Alternatively, watch our short video tutorial video below to learn how: How to Do Leverage Trading on bitoftrade

Now that you know how to make a leveraged trade on our platform, it’s time to discuss adding a stop loss to your leverage trade.

How to add stop-loss to your leverage trade

While we’re in a bear market, it’s more important than ever to limit the risks involved with leveraged trading. Stop-loss is one of the best methods you can use to do this! Not only can you control the amount you lose, but stop-loss lets you manage your trades like a pro.

Adding a stop-loss order to your leveraged trades on our platform is easy, and all you have to do is watch our video tutorial to find out how: How to Place A Stop-Loss Order on bitoftrade

Don’t forget: there’s no fee involved with applying a stop-loss order when trading on our platform!

Benefits of leverage trading with bitoftrade

Our trading platform comes with all the benefits of CEXs and DEXs combined! You can tend to all your trading needs on one single platform. The features and benefits of trading with us include:

Plenty of tokens to choose from! You can leverage trades with the following pairs: ETH/USDC BTC/USDC YFI/USDC CRV/USDC 1INCH/USDC ZRX/USDC MKR/USDC COMP/USDC SUSHI/USDC LINK/USDC AAVE/USDC

Transparent fees! We understand how annoying it can be when you discover hidden fees once your trade has been executed, that’s why we show you all the fees involved with your trade before you click “Confirm”!

You can trade anonymously! No KYC, verification, or registration is needed for trading. As a non-custodial trading platform, our users trade anonymously and still enjoy all the features and benefits we offer. However, if you’re using our fiat2crypto widget, you’ll need to conduct a one-time verification process.

Our platform is user-friendly! Our user-friendly interface allows traders of all levels to trade and easily manage their crypto portfolios.

Excellent support team! You’ll have access to our friendly support team, who go out of their way to help all our users. Chat to our team via phone, live chat, and email!

Everything you need in one platform! We offer the benefits of many popular DEXs and CEXs but without their limitations. You can trade anonymously with multiple trade types, benefit from our dedicated support team when you need them, and expand your trading potential.

Explore bitoftrade’s other features

Now you know how a leveraged trade works and how to protect your portfolio against risk with stop loss, you’re fully armed to start expanding your profit potential on our platform.

Did you know that leveraged trading is just one of our advanced features? That’s right! We have many more awesome features you can use to expand your trading portfolio.

On our platform, you can also make swap trades, market orders, and limit orders! Swap all tokens across our five integrated networks: Ethereum, Fantom, Polygon, BSC, and Avalanche!

Our article The Fundamentals of Crypto Limit Order Trading will give you more knowledge on limit orders.

Additionally, we’ve recently launched our new fiat2crypto widget. Read all about it here.

You’ll be delighted to know that we’ve got more exciting features coming to the platform soon, taking your trading strategies to the next level! Expect to see the launch of our BTRADE token, a tokens page and a decision-making dashboard, our new Academy for newbies, and our crypto wallet! Keep an eye out for these fast-approaching upgrades.

Follow us on our official social media channels (links below) to get the latest news, stay up-to-date, and be the first to know about fun competitions!

You can learn more about leverage trading below:

Crypto Leverage vs Margin Trading: Which One To Use?

How to Earn Crypto Passive Income

Stay in loop with all things bitoftrade via our social media channels:

Official Telegram

Official Discord