Today ETC ranked #18 on CoinMarketCap. Total market cap is $5,084,033,524. ETC token is one of those that any trader knows about.

Many consider it to be a successful crypto project with a big head start and a bullish trend right now. However, some experts are raising their voices, discouraging crypto novices and experienced traders from buying this cryptocurrency. We want to find out if we can rely on him in the current fluctuation in the crypto market.

What is Ethereum Classic?

It seems that, firstly, we need to explain how Ethereum differs from Ethereum Classic. Let it be our starting point.

ETC is a hard fork from Ethereum that was launched in 2016. A little clarification is worth making here: there is a lot of confusion about which Ethereum network is a fork. It is correct to note that both blockchains became forks at the moment of separation. That's what we're going to talk about.

Fork in crypto means an update of the blockchain protocol, in which the nodes of the old version of the network can interact with the nodes of the new version (soft fork) or in which the chain is divided into two independent ones (hard fork). A hard fork is a replication of an already existing blockchain, resulting in an independent blockchain with a unique cryptocurrency.

Ethereum Classic turned out to be the first fork to copy the Ethereum blockchain. Subsequently, forks have taken place with Bitcoin (there are four active hard forks) and other popular blockchains.

Why did the developers need to launch a new project based on the code of an already successfully functioning blockchain system?

Ethereum Classic came into existence when the Ethereum community split into two camps deciding which solution to choose after the massive TheDAO hack and Ether theft that happened the day before.

In 2016, less than a year after the commercially successful launch of the unique Ethereum project, a hacker, using weaknesses in The DAO code, managed to steal 3.64 million ether, which at the time of the hack amounted to 5% of all ETH equivalent to $53 million.

Decentralized venture fund The DAO at that time owned 15% of all ETH, and the price continued to rise until day X - the hack. When reports of the attack reached the public, the day eventually became a record day for the number of transactions with Ethereum — its price fell by 33%, from $21 to $14.

Here's the vulnerability: The DAO smart contract was written in a way that whenever someone withdraws money, the smart contract first sends the money and then updates that person's balance. The hacker used a malicious smart contract that cost 258 ETH at a time, and then prevented the contract from updating, which allowed him to withdraw the same ether over and over again.

Ethereum creator Vitalik Buterin has found a way to get his money back through a procedure called a hard fork. It would seem that everything is fine because this is the solution to save investors who have lost their investments. However, this is contrary to the ethics of cryptocurrency — it should always remain decentralized.

In fact, Buterin proposed a centralized solution to save the company's reputation. 97% of the community voted to restore the lost funds, but a small part of the community turned out to be resolute to the changes because "code is the law." So, a project called Ethereum Classic emerged.

What Do We Know about Ethereum Classic?

ETC Token: What is ETC Used For?

In essence, the software of Ethereum Classic is no different from the Ethereum captained by Vitalik Buterin. The Classic network enables developers to use open-source code to develop decentralized applications (dApps) and create ERC-20 tokens.

We are used to the term Ethereum Virtual Machine (EVM). Let's now remember that Ethereum Classic smart contracts are run on the Sputnik Viral Machine. DApps built on the Ethereum Classic are designed with the Emerald Software Development Kit.

Ethereum Classic developers adhere to the Proof-of-Work protocol and, unlike Ethereum, do not plan to switch to Proof-of-Stake. The network, just like the ecosystem of Bitcoin or Ethereum, needs miners to function. Miners are rewarded for completing blocks of verified transactions in the native currency of the network, ETC.

Is it profitable to be a miner in this era of predominant staking? You can quickly calculate and find out how much an Ethereum Classic network miner can earn here.

Both Ethers, ETC and ETH, are the same in terms of usage. Users of the Ethereum Classic pay the gas price in ETC. Otherwise, ETC is like any other currency. There are cryptocurrency staking and lending options, but Ethereum Classic does not provide such an opportunity. A user can get additional earnings or passive income by owning ETC using other crypto aggregators and exchanges.

Proof-of-Work principles & Change to the Ethash Mining Algorithm

As we have noted, Ethereum Classic is a blockchain whose creators strongly adhere to certain principles, including the question of which consensus algorithm will be used. So, if Ethereum goes in the Proof-of-Stake direction, testing a new upgrade, Ethereum Classic is making updates that aim to increase miner participation and network security.

In 2020, ETCLabs implemented the Thanos (ECIP-1099) protocol. The objective of the update was to reduce the DAG (Directed Acyclic Graph) size and increase access for GPU (Graphics Processing Unit) miners. It seems worth stopping here and sorting out the terminology in more detail.

The functioning of the Ethash algorithm, on which Ethereum is based and which became the basis of the new ETChash algorithm of Ethereum Classic, requires a large amount of memory and an ever-increasing dataset (this is what they call DAG). The DAG file size increases every 30,000 blocks, and it's in GB. At first, 1GB was enough to build blocks, but subsequently, the numbers increased. In simple terms, by 2020, the power of many GPU miners is no longer enough participate in the block-building race.

The task of updating ETCLabs was to reduce the size of the DAG file to well below 4GB. The Thanos upgrade gave miners with 3GB and 4GB GPU systems the ability to continue working without having to replace aging graphics cards.

The current Ethereum Classic's DAG size is 3.0703 GB. To compare: Ethereum's DAG size is 5.0391 GB. That is, the threshold entry for potential miners of the network is higher than required by Ethereum Classic.

Recall once again that with the Thanos Upgrade, Ethereum Classic also launched an updated amd modified Ethash algorithm, called ETChash. This means that any Ethereum miner is able to find a place in the Ethereum Classic ecosystem.

Ethereum vs Ethereum Classic

We started with a story about how Ethereum split into two independent blockchains with different development strategies and approaches to understanding crypto.

Let's now define the features that make the project different from each other:

The data shows how much ETH is superior to ETC in capitalization and promotion of the network and token. However, we want to emphasize that, taking into account important indicators, you should pay attention to the advantages of Ethereum Classic. Here is what they are:

PoW consensus gives the miners an advantage to shift to ETC while continuing on the same Ethereum blockchain;

Ethereum Classic is smart contract capable;

Ethreum Classic is much cheaper than ETH.

Ethereum is positioned as an open-source platform for decentralized applications. It aims to be accepted by the wider community and improve the network to serve an ever-increasing number of users.

Ethereum Classic aims to provide an unlimited way to manage digital assets and provide the ability to transfer money through smart contracts while keeping the system in a classic state without any significant changes.

How the Merge Will Affect Ethereum Classic

The official and full-scale transition of the Ethereum network to Proof-of-Stake will take place on September 19th. For a month now, there has been a trend on the market: the closer the Merge, the higher the price of ETC jumps.

Why is this happening? Some experts believe that the Merge is a win-win for Ethereum's current rivals. The implication is that when the monopolist (we don’t count Bitcoin) leaves the Proof-of-Work blockchain space, it will be easier for other crypto companies to raise market capitalization, expand communities, and attract new miners.

However, there is also an opinion (based on statistics!), indicating a constant decline in the mining industry. We are talking about mining here for a reason: after all, the Ethereum Classic network is the first in line in demand among miners, and it can be among the Merge’s top gainers.

Vitalik Buterin, in one of his public statements, suggested that those miners who are not ready to switch to proof-of-stake should continue mining coins in the Ethereum Classic ecosystem. The developer said: “If you like Proof-of-Work you should go use Ethereum classic, it’s a totally fine chain”.

What changes are taking place right now among the mining pools and providers?

JPMorgan analysts have assumed that ETC will be the main beneficiary of the influx of miners after Ethereum's switch to PoS.

According to the WhatToMine service, which collects quantitative statistics about mining and allows you to check how profitable it is to mine selected crypto, Ethereum Classic takes the second line in the profitability assessment after Ethereum. Next in third place is Monero, whose market cap volume is slightly less than two times smaller than Ethereum Classic.

Bitmain-affiliated mining pool AntPool ended support for Ethereum on September 3. AntPool remains available to miners who mine Ethereum Classic (ETC) and other Ethash tokens. Moreover, the company encourages ETC mining. A little earlier in July, AntPool announced a $10 million investment in the Ethereum Classic ecosystem.

One of the largest mining pools in the industry, BTC.com, has also supported Ethereum Classic by launching ETC Pool with “zero-fee” mining for three months.

ETC Token Price Prediction 2022 – 2025 – 2030

According to 2miners, Ethereum Classic hit an all-time high record hash rate of 48.82 terra hashes per second (TH/s) the other day, September 5, 2022. The ETC hash rate is currently 7.87 TH/s. For comparison, let's point out that the Ethereum hash rate today is 66.59 TH/s, taking the first line at the top. What can these numbers tell us?

Hashrate is the total computational power needed to mine and process transactions on a blockchain. The rise of the Ethereum Classic hash rate may be is associated with the switching of Ethereum miners to the production of a "related" cryptocurrency in anticipation of The Merge. If the trend continues, it will bring more credibility to Ethereum Classic, as hash rate growth shows the level of security of the network against potential hacks. This is something investors are paying close attention to.

A high hash rate also tells about the number of miners in the network. The higher it is, the more decentralized the network - the less likely for the network to be took over.

Usually, the amount of reward is also directly related to the complexity of the mining process. That's why, let's say, it's profitable to mine Bitcoin - all the difficulties and personal expenses will pay off. So, if Ethereum Classic won't slow down, we can expect a great influx of miners into the network. Not only because the users of the Ethereum network change location on the eve of the Merge, but simply because Ethereum Classic will be the most profitable choice for miners.

The demonstration of hash rate growth is attractive for the project now because, in 2020, the company suffered 51% attacks. The attack lasted several days with losses of $1.1 million. At that time, the company implemented a MESS finality system to protect against 51% attacks.

ETC Price Prediction Candlestick Charts

As of today, Ethereum Classic (ETC) has a circulating supply of 136,765,687 with a total maximum supply of 230,000,000 ETC tokens. Let's take a look at the graph of the ETC token price change during different periods of the year.

Over the past three months, the value of ETC has been growing in leaps and bounds. As you can see on the chart, the token exploded in mid-July after a short drawdown and has not died down so far. Unlike many other altcoins, ETC has shown some semblance of stability during a period of market volatility.

During 2022, we have seen a sharp drop twice, which, however, was followed by a fairly rapid rise:

What is the ETC movement today:

To understand candlestick basics to make accurate predictions in more detail, check out our article on crypto candlestick charts.

ETC Token Price Prediction Techical Analysis

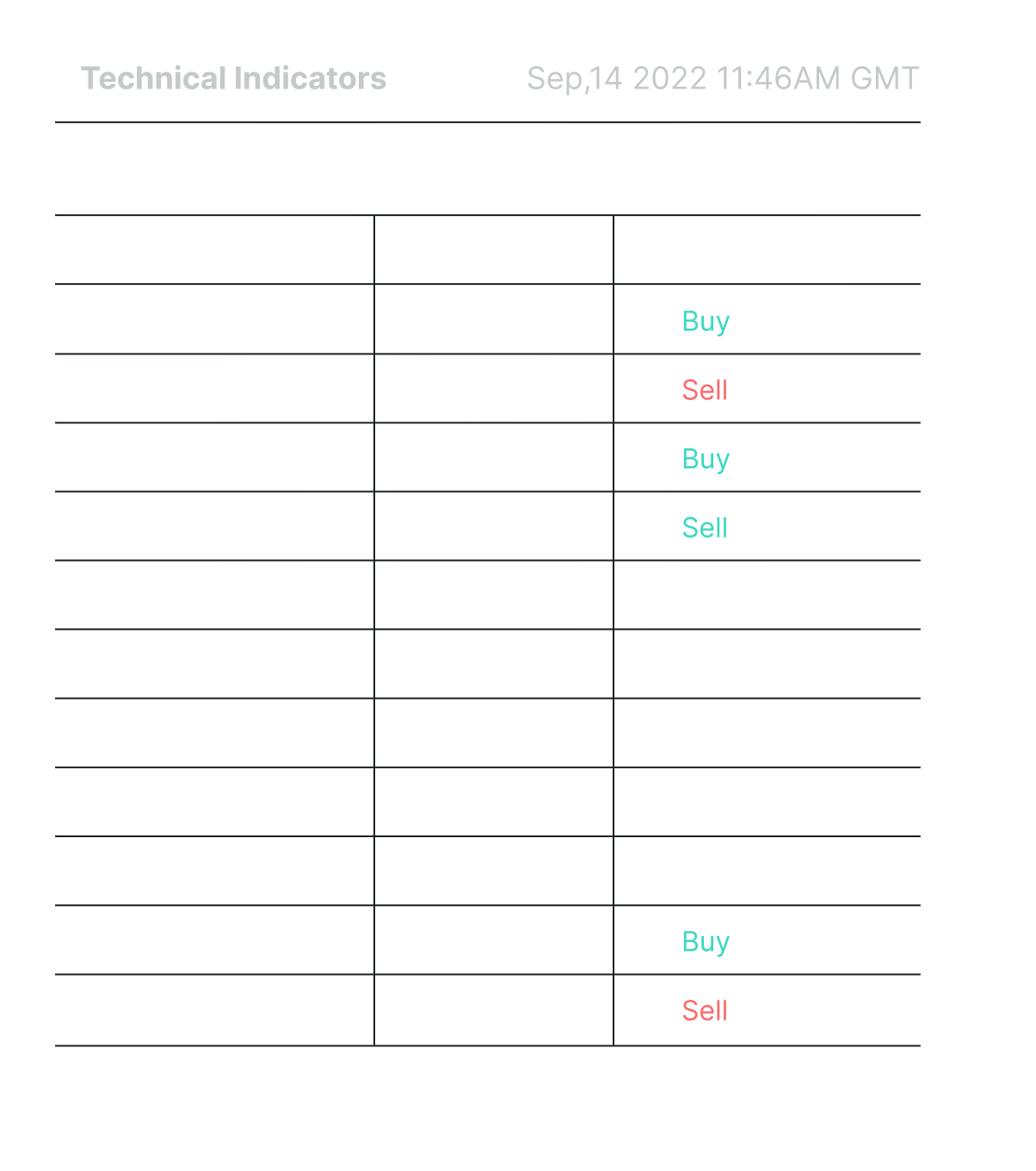

We can see that the daily technical indicator shows us a neutral trend of ETC price, однако нет единого направления ‘’Buy’’ or ‘’Sell’’. In this case, traders should carefully consider the choice of an indicator that will allow them to make a decision. Learn how to choose indicators that will help you in day trading here.

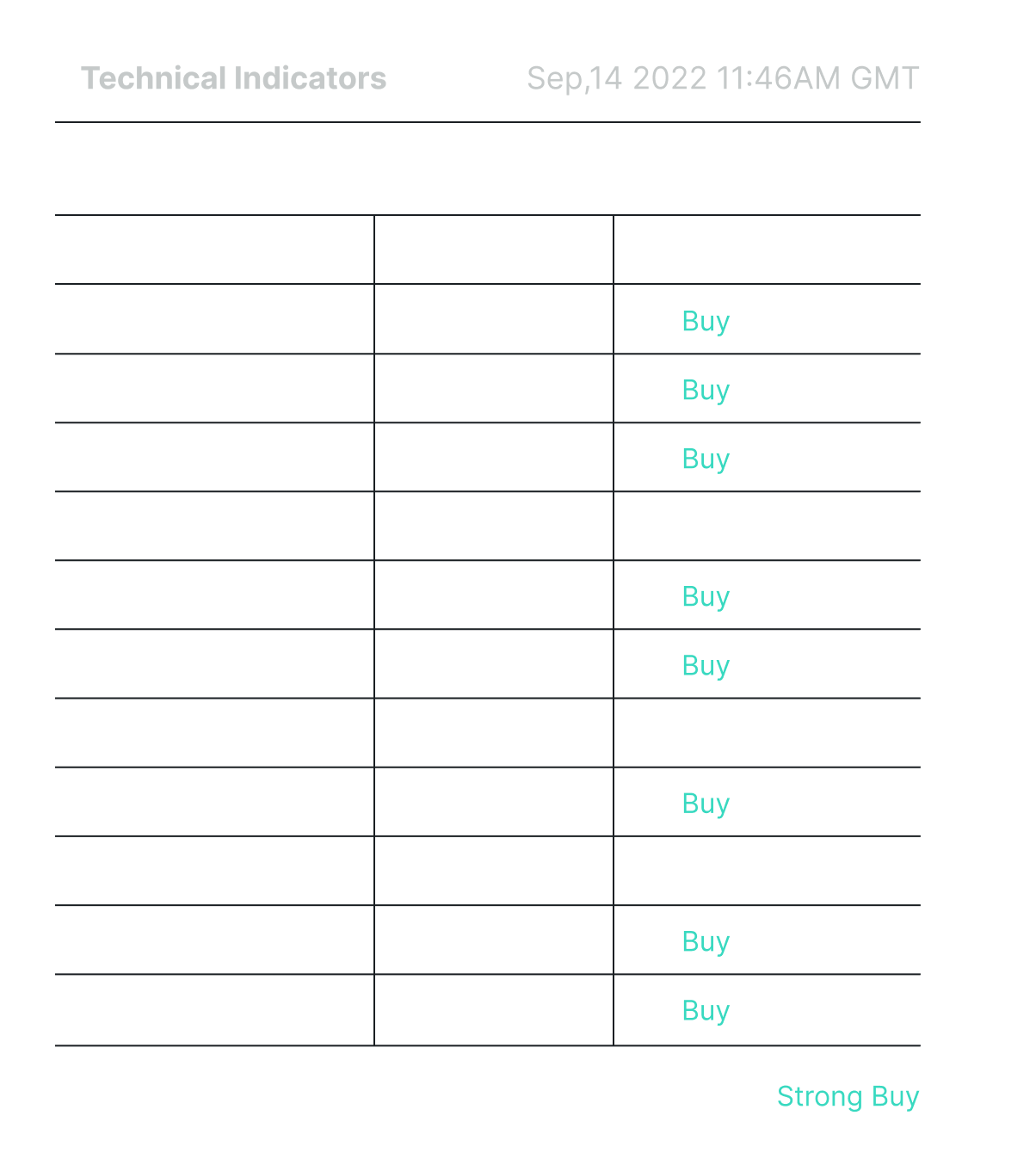

If we evaluate ETC in the future of the week, technical crypto indicators indicate the prospects of buying a currency:

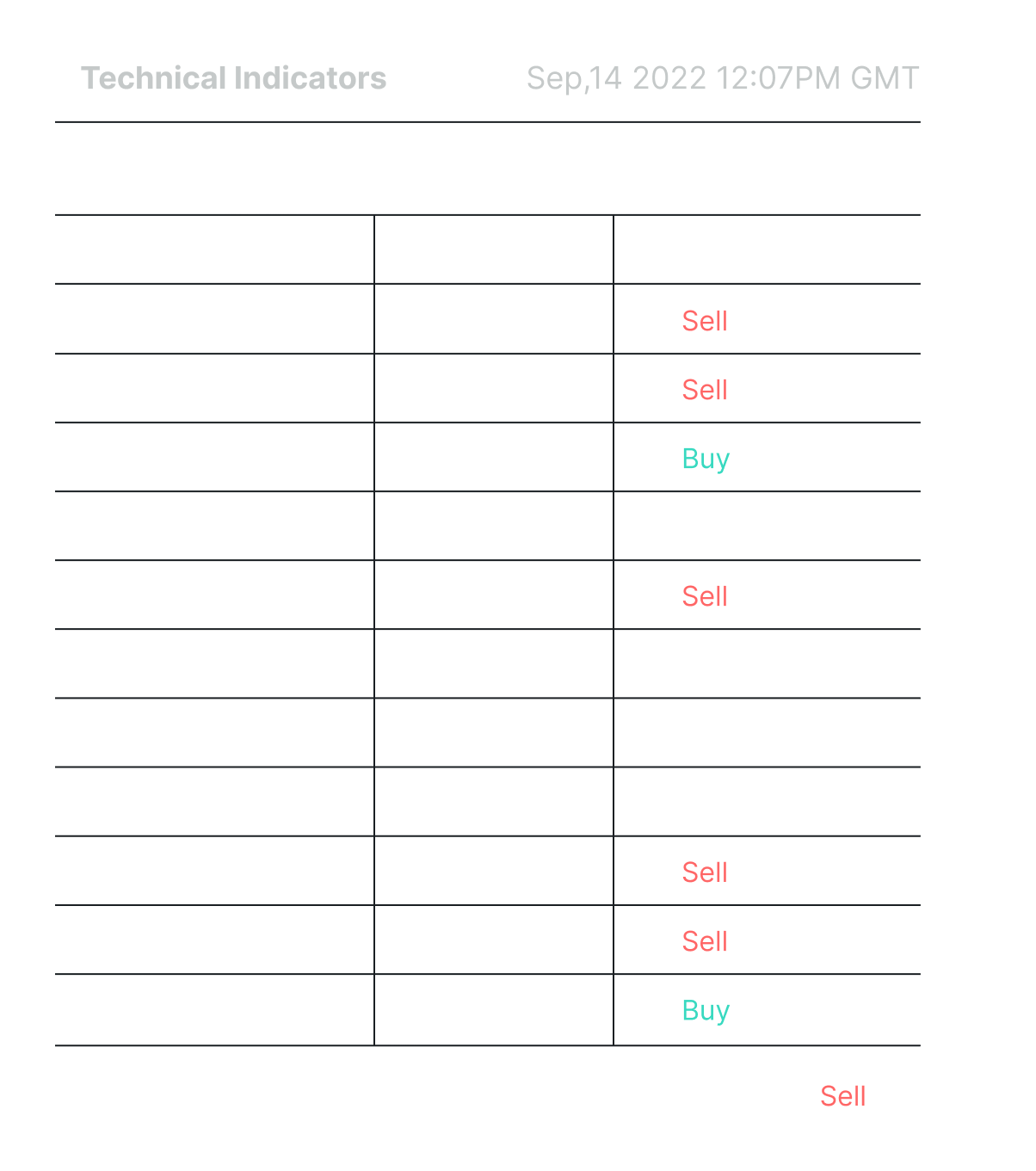

And finally, indicators that evaluate the movement of the ETC price during the month demonstrate the stability of the currency in the long run:

One of the most popular indicators among traders is MACD and Stochastic Oscillator. In the hyperlinks, you can find guides on how to put them into practice.

Conclusion

Ethereum Classic is a project with a controversial history whose authors can stick to the moral principles they believe in.

By objective indicators, Ethereum Classic is not the most advanced and popular project in the crypto industry, but it occupies a significant place among Proof-of-Work networks.

There are fair judgments that if there is no skyrocketing, the future of the company will remain neutrally positive. Ethereum Classic has already proven its effectiveness more than once. ETCLabs managed to cope with a 51% attack and did not just close their eyes to what happened, trying to absolve themselves of responsibility, as often happens in 2022, when companies go bankrupt and become victims of cyber attacks, but took several actions to improve the network structure.

ETC token can replenish your crypto portfolio. On the bitoftrade platform, you can make anonymous without KYC transactions with a variety of tokens, including ETC.

Find more information on how to connect your MetaMask or Trust Wallet and start trading in our video guides.

Find out more about how to swap tokens and trade with leverage on bitoftrade.

Join our social media channels to be up-to-date with the latest news: